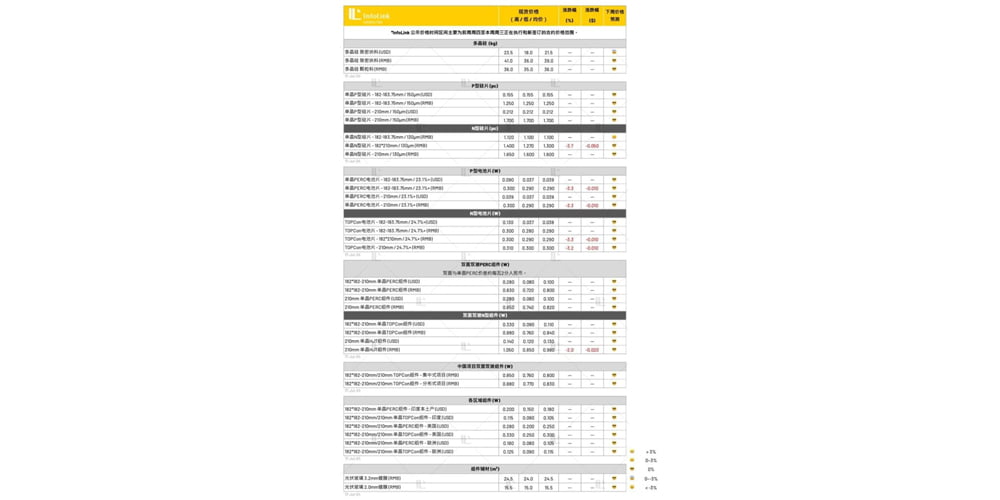

Silicone Prices

The price of silicone in the upstream sector has entered a phase of stagnation at a low point, maintaining overall stability with minimal changes or updates in pricing. As the third quarter begins, an increasing number of silicone companies, including leading firms, are implementing significant production cuts or suspensions. Most of these actions align with expectations, though there are some cases where the adjustments were more urgent than anticipated, driven by ongoing negative profit pressures. This is likely to accelerate negative production growth in the third quarter. The increased rate of negative production growth is alleviating some inventory reduction pressures on the supply side, but the core issue remains: there must be a market choice between existing production capacity and new production capacity in the face of fierce competition, a challenging decision for any manufacturing enterprise. Additionally, the prospects for whether a considerable amount of new capacity can be successfully launched after delays seem

Silicon Wafer Prices

Recently, the price trends for silicon wafers across different specifications have begun to diverge. The prices for 182 and 183N wafers have risen due to earlier low-price sell-offs and rapid inventory de-stocking. Additionally, the current inventory levels have been impacted by the dilution effect of specific specifications, leading to signs of tightening in this category. Manufacturers have started negotiating price increases for this specification, with quotes shifting from 1.1 RMB per wafer to 1.12 RMB per wafer. In contrast, the supply of larger 210RN series wafers remains relatively abundant, prompting manufacturers to consider shifting focus to smaller-sized production.

This week, silicon wafer prices have remained stable, with M10 and G12 sizes in the P-type category trading at around 1.25 and 1.7 RMB per wafer, respectively. For N-type wafers, the M10, G12, and G12R sizes have seen transaction prices around 1.1, 1.6-1.65, and 1.3 RMB per wafer, respectively.

Although there are signs of an increase in the number of transactions at the price of 1.12 RMB per wafer compared to last week, manufacturers’ experimental price hikes for 183N have not yet led to widespread acceptance, and the mainstream average price for 183N remains steady at 1.1 RMB per wafer.

Battery Cell Prices

This week, prices remain relatively stable with minor fluctuations. The price for P-type M10 and G12 cells has dipped to 0.29 RMB per watt. For N-type cells, the average price of M10 TOPCon cells also stays at 0.29 RMB per watt, with lower-priced options even falling below 0.28 RMB per watt. Currently, prices for G12R and G12 TOPCon cells range from 0.29 to 0.30 RMB per watt.

The battery sector continues to face losses, with M10 TOPCon cells calculated at a tax-inclusive cost of 0.29 RMB per watt reflecting a gross margin of -11% to -12%. High inventory levels contribute to a pessimistic market outlook. Given concerns over costs, there appears to be no room for further price declines. However, from a supply-demand standpoint, an oversupply situation persists. Companies in this segment are struggling to achieve profitability in the long term, while some firms are managing to uphold prices for high-efficiency battery products, maintaining sales at no lower than

Component Prices

This week, prices have experienced slight fluctuations. The price of TOPCon modules is approximately between 0.76-0.88 RMB per watt, with some centralized projects adjusting their pricing, leading to an overall price range of around 0.76-0.80 RMB per watt. The average price rests between 0.80-0.83 RMB per watt. Some orders are facing delivery risks, and leading manufacturers still aim to maintain prices within the range of 0.78-0.80 RMB. Current spot prices are close to 0.78 RMB, with some dipping to as low as 0.76-0.77 RMB. Manufacturers are continuously reducing the production of low-power products and accelerating the phase-out of PERC products. Some are hoping to initiate a price increase to halt the downward trend. However, a fundamental recovery relies on an increase in demand, which has yet to show clear signs of improvement. Ongoing low-price orders and rapid price drops of inefficient products are disrupting market stability, making it challenging for component prices to recover.

The price range for 182 PERC double-glass modules is approximately 0.72-0.85 RMB per watt, with a significant reduction in domestic projects, causing prices to gradually fall below 0.80 RMB. There haven’t been many HJT module project deliveries recently, with prices ranging between 0.85-1.05 RMB per watt. The average price is moving towards the range of 0.96-1.00 RMB, and prices

Price Explanation

The InfoLink published price range is primarily based on contract prices executed and newly signed from the previous Thursday to the current Wednesday.

Spot prices are mainly referenced from information provided by over 100 manufacturers. The published price is derived from the most frequently traded “mode” data in the market (not a weighted average) and is adjusted as necessary based on actual market conditions.

The dollar price of polysilicon primarily reflects the dollar price range corresponding to polysilicon from “non-Chinese origins,” converted from non-RMB prices.

For solar cells, the high dollar price for PERC/TOPCon M10 size solar cells is primarily based on prices for solar cells produced in Southeast Asia.

In the module segment, the RMB price represents domestic quotes in China, with the average price based on the factory delivery price for the week (excluding inland transportation costs). This mainly accounts for distributed and centralized projects delivered during the current period, with high and low prices reflecting the market status of second-tier manufacturers or certain earlier project prices. The dollar price represents overseas prices for non-China regions, quoted on an FOB basis excluding tariffs, converted from non-RMB prices