Recently, the Vietnam Trade Relief Administration issued an announcement that the Turkish government’s General Directorate of Imports (DGI) decided to grant tariff exemptions to four companies after imposing a tariff of $25 per square meter on photovoltaic modules from Croatia, Jordan, Thailand, Malaysia and Vietnam.

Heavy tariffs are coming, and Southeast Asian photovoltaics are under pressure

At the end of November last year, the Turkish government launched an anti-dumping investigation on photovoltaic products from many Southeast Asian countries. The reason behind it is actually very simple: Turkey suspected that companies in these countries circumvented the $20 per square meter anti-subsidy tariff imposed on Chinese photovoltaic products by “borrowing the way”. To prevent this “detour” behavior, the Turkish General Directorate of Imports launched a comprehensive investigation of five Southeast Asian countries. After several months of review, Turkey finally decided in March this year to impose a new tariff of $25 per square meter on photovoltaic products imported from these countries, which was 25% higher than the previous tariff.

As an important production area for the global photovoltaic industry, Southeast Asian countries have always been the production base of many photovoltaic manufacturers, especially as Chinese photovoltaic products face tariff barriers in many global markets, Southeast Asian manufacturers have gradually become an important part of the global photovoltaic product supply chain. However, the adjustment of the tariff policy means that many Southeast Asian manufacturers will lose their price advantage in the Turkish market. But less than a week after the new tariff policy was implemented, things have changed again.

JinkoSolar and four other companies are exempted

Turkey’s above-mentioned tariff policy is from September 27, but on October 2, Vietnam reported that four companies have obtained tariff exemptions from Turkey. These include JinkoSolar’s subsidiary in Malaysia, JA Solar’s subsidiary in Vietnam, Trina Solar’s subsidiary in Thailand, and Vina Solar, a Vietnamese module manufacturer acquired by Longi Green Energy a few years ago. The photovoltaic modules of these companies will not be affected by the tariff of US$25 per square meter, and the previous tariff policy will still be implemented. So why does Turkey treat these companies differently?

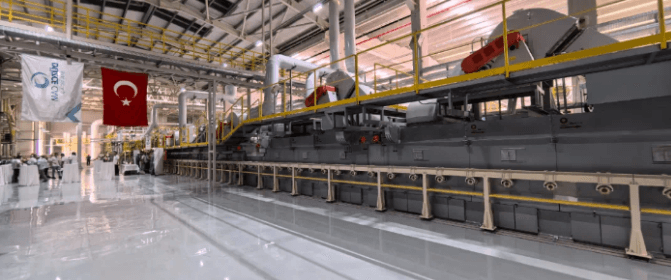

Finlay Colville, director of photovoltaic technology research at PVTECH, a professional media in the photovoltaic field, once pointed out in a blog post that Turkey currently plays an important role in Europe’s solar photovoltaic manufacturing plan, especially by signing equipment manufacturing contracts with a large number of Chinese suppliers. Turkey is taking advantage of global industrial chain opportunities to promote the rapid development of its local photovoltaic industry. As Turkey’s cooperation with Chinese photovoltaic equipment manufacturers continues to deepen, the international competitiveness of the country’s photovoltaic industry is expected to further enhance.

However, if barriers are erected in terms of tariffs, which will dampen the investment enthusiasm of manufacturers, it is likely to have a negative impact on the country’s photovoltaic industry.

By imposing tariffs and implementing exemptions, Turkey not only protects its local manufacturing industry, but also lays the foundation for possible cross-border cooperation in the future. JinkoSolar, JA Solar, Trina Solar and other companies have a large production and sales network worldwide, and their technology and resources can complement those of local Turkish companies. For such companies, it is reasonable for Turkey to choose to open the net.