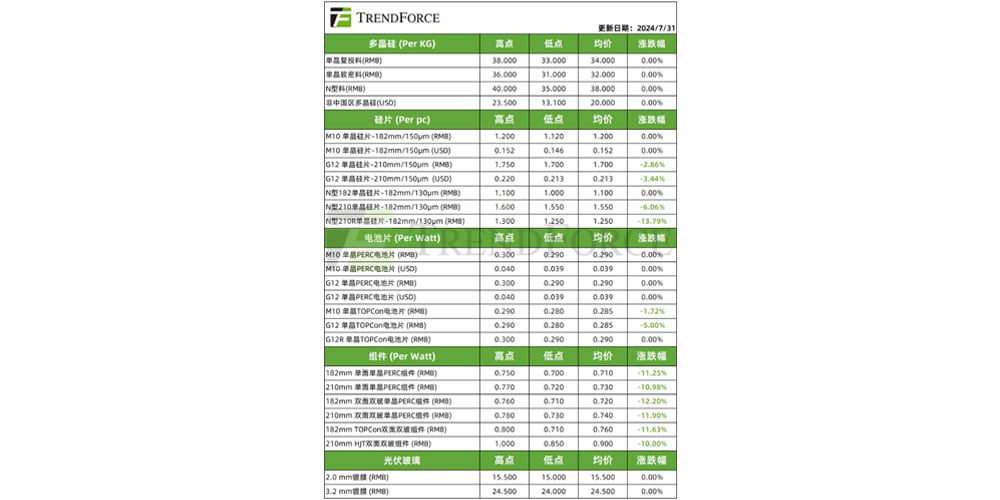

On August 8, TrendForce released the latest pricing for the photovoltaic supply chain:

Silicon Material

This week, the price of silicon material showed that the mainstream transaction price for monocrystalline reprocessed silicon is 34 yuan/kg, while the price for monocrystalline dense silicon is 32 yuan/kg; N-type material is quoted at 38 yuan/kg.

Trading Situation: As of the beginning of the month, most manufacturers have basically completed order signing. The tug-of-war regarding price trends between upstream and downstream participants has eased somewhat, particularly after frequent inquiries from futures traders, which has gradually increased the likelihood of expanded demand for polysilicon. This week, a small number of price increases were contributed by futures traders and merchants; however, the transaction price range for mainstream long-term contracts has remained stable without significant fluctuations.

Supply and Demand Dynamics: This month, the overall output of polysilicon is expected to drop to around 60 GW, primarily due to significant production halts by some of the top six manufacturers. Amid tight cash flow, most manufacturers are prioritizing the shutdown of high-cost, outdated production capacity while maintaining the operation of low-cost new capacity. The supply-demand relationship continues to show signs of improvement, with the polysilicon supply-demand gap already narrowing to about 7 GW this month. Should the output continue to be adjusted downward in September and October, the supply-demand gap may reach equilibrium. Coupled with the launch of polysilicon futures and the efforts of futures traders and merchants to reduce some inventory, it is possible that polysilicon prices may see a turning point as early as mid-Q4; however, the stability of prices fundamentally depends on the clearance of excess production capacity.

Price Trends: This week, prices remain stable, with a small amount of premium orders unable to push mainstream prices higher; the crystal pulling sector, facing severe losses, struggles to absorb the pricing pressure from multicrystalline silicon manufacturers.

Silicon Wafers

This week’s silicon wafer prices: The mainstream transaction price for P-type M10 wafers is 1.15 yuan/piece; P-type G12 wafers at 1.70 yuan/piece; N-type M10 wafers at 1.10 yuan/piece; N-type G12 wafers at 1.55 yuan/piece; and N-type G12R wafers at 1.25 yuan/piece.

Supply and Demand Dynamics: In August, the differentiation in wafer production continues; leading manufacturers have increased their production share compared to the previous month, while mid-to-lower-tier manufacturers frequently face production cuts due to ongoing losses and cash flow issues. Additionally, the concentration among leading specialized manufacturers has increased for the first time this year, while the output layout of integrated manufacturers has shifted. Against the backdrop of price-cost inversion across the entire industry chain, losses in the wafer segment continue to erode the operational profits of integrated module manufacturers.

Price Trends: This month, the supply-demand gap between the wafer segment and batteries is narrowing, with strong support for wafer prices. However, considering existing inventory levels (approximately 38GW), there is oversupply across all specifications. If downstream battery prices decrease or demand declines, there is a possibility of corresponding adjustments in wafer prices.

Battery Cells

This week’s battery cell prices: The mainstream transaction price for M10 battery cells is 0.290 CNY/W, and for G12 battery cells, it is also 0.290 CNY/W. The mainstream transaction price for M10 monocrystalline TOPCon cells is 0.285 CNY/W, while for G12 monocrystalline TOPCon cells, it is 0.285 CNY/W.

Production and Inventory: In August, the production of battery cells saw a slight month-on-month decrease due to insufficient demand. Manufacturers adjusted their production schedules accordingly. Notably, mid- to downstream manufacturers significantly increased their clearing rates and speed. This shift was particularly pronounced after cross-sector newcomers, who had previously expanded aggressively, announced substantial losses and began to shut down operations.

Price Trends: This week, prices for all specifications of battery cells remained stable. Integrated manufacturers showed a decreasing trend in external procurement orders compared to last month, with a higher concentration of order demand. Specialized battery cell manufacturers are facing short-term pressure on their bargaining power. The trend of price competition to secure orders continues, although overseas battery cell outsourcing orders remain strong.

Components

Component Prices This Week: The mainstream transaction price for 182 mm monofacial PERC modules stands at 0.71 RMB/W, while 210 mm monofacial PERC modules are priced at 0.73 RMB/W. The price for 182 mm bifacial double-glass monocrystalline PERC modules is 0.72 RMB/W, and for 210 mm bifacial double-glass monocrystalline PERC modules, it is 0.74 RMB/W. The mainstream transaction price for 182 mm bifacial double-glass TOPCon modules is 0.76 RMB/W, and for 210 mm bifacial double-glass HJT modules, it is 0.90 RMB/W.

Supply and Demand Dynamics: Looking at the order conditions from manufacturers in August, apart from a leading company that saw an order delivery boost production schedules, other manufacturers have been cautious in their production to avoid inventory buildup that could lead to impairment losses. In terms of end-user demand, overseas demand is steadily progressing. In Europe, the vacation season has limited demand strength, while the Middle East and Africa regions show steady demand growth. Domestically, distributed demand has yet to recover, and the installation plans for ground-mounted power stations are expected to kick off at the end of Q3; overall, the market is currently in a dormant phase driven by orders.

Price Trends: This week, prices for all types of components have stabilized; however, competition is gradually shifting from inter-manufacturer rivalry within the same technology type to competition across different technology types. To increase market share for other platform technologies, certain manufacturers are aggressively implementing a price-for-volume strategy, complicating the competitive pricing landscape for components.![]()