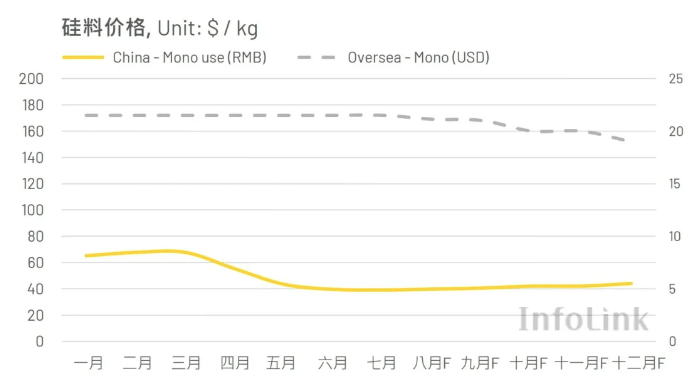

Silicon Materials: Highly Concentrated Production Capacity and Dominant Companies Influencing Price Trends

First, focusing on the silicon materials sector, after a prolonged period of significant decline, prices in China began to stabilize in July, falling to approximately 36-41 RMB per kilogram. As these prices are below the industry’s production costs, many silicon companies plan to gradually reduce production or conduct maintenance in the third quarter while phasing out outdated capacity. On the other hand, the retirement of old capacity introduces uncertainty regarding the establishment of new capacity by leading enterprises in the market. Given the high concentration of silicon production capacity, the decisions made by these leading firms will significantly influence future price trends. Continuous monitoring of the actual production by various companies in the third quarter is essential; if supply can be effectively reduced, there is potential for a slight rebound in Chinese silicon prices by the end of the third quarter.

In contrast to the sluggish market for Chinese silicon, overseas silicon has a certain scarcity due to the U.S. UFLPA act’s sourcing requirements, maintaining prices between 18-24.5 USD per kilogram over the long term. Recent instability has arisen from policy changes, such as the U.S. launching anti-dumping and countervailing investigations in May against battery and module exports from four Southeast Asian countries. It is expected that following the implementation of tariffs in the fourth quarter, exports from these countries to the U.S. will be severely restricted, potentially impacting the overall demand for overseas silicon and leading to price fluctuations.

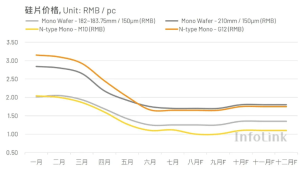

Silicon Wafers: Diverse Product Specifications and Diverging Price Trends

Due to the decline in upstream silicon material prices and the accumulation of inventory, silicon wafer prices rapidly dropped in the first half of 2024, fully breaking through the industry’s production cost line. By the end of July, most product prices had bottomed out and remained stable for the time being. The price for P-type M10 wafers was 1.25 RMB each, while G12 was priced at 1.7 RMB. For N-type products, the M10 price stood at 1.1 RMB each, and G12 ranged from 1.6 to 1.65 RMB. Notably, G12R wafers experienced a price decline due to sluggish demand, with the mainstream price dropping from 1.35 RMB in early July to 1.25 RMB.

Looking ahead to the second half of the year, the main factors influencing silicon wafer prices or potential positive developments are expected to come from the upstream silicon material sector. As previously mentioned, a planned reduction in silicon supply in this sector could lead to a slight price rebound by the end of the third quarter. The anticipated increase in upstream prices is likely to drive silicon wafer prices upward.However, the business strategies of silicon wafer companies have also led to price differentiation among products of different specifications. For instance, as N-type products become mainstream in the market, P-type wafers, whether in M10 or G12 sizes, are expected to maintain a premium due to relatively tight supply. On the other hand, N-type products, particularly in the G12 series, are still constrained by downstream demand, with G12R prices recently continuing to decline. Given the diminishing cost-effectiveness of larger sizes, some companies may shift to producing smaller silicon wafers. Meanwhile, with the earlier clearance of substantial inventories, some companies are now attempting to raise prices for the M10 wafers, which hold the highest production capacity share. Overall, the operational strategies of various silicon wafer companies regarding product selection, production volume control, and pricing policies will be crucial factors in determining price trends for the second half of the year.

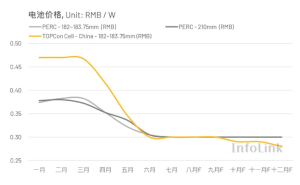

Batteries: Upstream and Downstream Pressure Transmission; Overall Supply Remains Relatively Oversupplied

As of the end of July, battery prices are also hovering at the bottom range, with P-type M10 and G12 priced at 0.29 yuan per watt. For N-type products, the mainstream price for M10 TOPCon batteries is also 0.29 yuan per watt, while G12R and G12 TOPCon batteries are priced at 0.29 and 0.30 yuan per watt, respectively.

Due to the overall gross margin of the battery sector dropping below -10%, the space for continued price declines has narrowed. It is expected that in the second half of the year, mainstream M10 TOPCon battery prices will stabilize in the range of 0.29 to 0.30 yuan per watt, making significant further price drops unlikely.

It is noteworthy that as specialized battery companies complete upgrades from PERC to TOPCon in the third quarter, the majority of this production capacity is primarily aimed at manufacturing the 210RN specification, which introduces potential changes in supply and demand dynamics.

The battery sector is constrained by upstream and downstream pressures, and it remains to be seen how changes in silicon wafer production, module supply, and end-user demand will impact the market. Additionally, with battery supply continuing to be oversupplied and inventory levels remaining relatively high, companies are also struggling to turn losses into profits in the short term, leaving the price trend for the latter half of the year still uncertain.

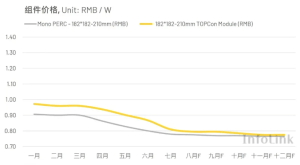

Components: Expected Prices to Stabilize Due to Terminal Demand

Due to variations in product specifications, project types, and domestic and international market differences, overall component prices are showing a diverging trend. In the Chinese market, as of the end of July, the price for M10 TOPCon components is approximately between 0.76 and 0.85 RMB per watt, while the M10 PERC double-glass components are priced around 0.72 to 0.82 RMB per watt.

In overseas markets, examining the import prices of TOPCon components across various regions, July saw European prices decline due to falling traditional energy prices, which constrained photovoltaic demand. By the end of the month, component prices in Europe ranged from 0.09 to 0.125 USD per watt, while prices in Brazil and the Middle East were about 0.085 to 0.12 USD and 0.09 to 0.12 USD per watt, respectively. For imported PERC components, overseas market prices generally ranged from 0.09 to 0.10 USD per watt.

Analyzing the price trends for components in the second half of the year, it is important to note that prices across the supply chain have bottomed out. Some component manufacturers are attempting to raise prices; however, due to persistently weak terminal demand and a lack of favorable policies, market demand remains insufficient to absorb the excess supply. Additionally, some companies are quoting prices below market rates to secure orders, further limiting the potential rebound in component prices. Therefore, it is prudent to view the component prices in the second half of the year conservatively, with a higher likelihood of continued stabilization.

Slow Capacity Clearance and Price Recovery Remain Challenging

In summary, as prices across various segments have largely bottomed out and production companies are generally facing losses, the speed of supply-demand balance and large-scale capacity clearance has become a focal point in the market. However, in the second half of 2024 and even into the first half of 2025, aside from capacity adjustments by leading enterprises, some outdated capacities may still receive financial support from cross-industry companies or public sectors. Additionally, the potential entry of new players must also be considered. Therefore, the overall capacity clearance will be a relatively lengthy process, making a significant price rebound in the short term quite difficult.

Conversely, it is precisely during these turbulent cycles in the industry that the operational strategies of photovoltaic companies are put to the test. Factors such as cash flow management, integration of upstream and downstream capacities, product differentiation, and technological innovation will be crucial for companies to break free from the current price competition and navigate through these challenges.