Silicon Material Prices

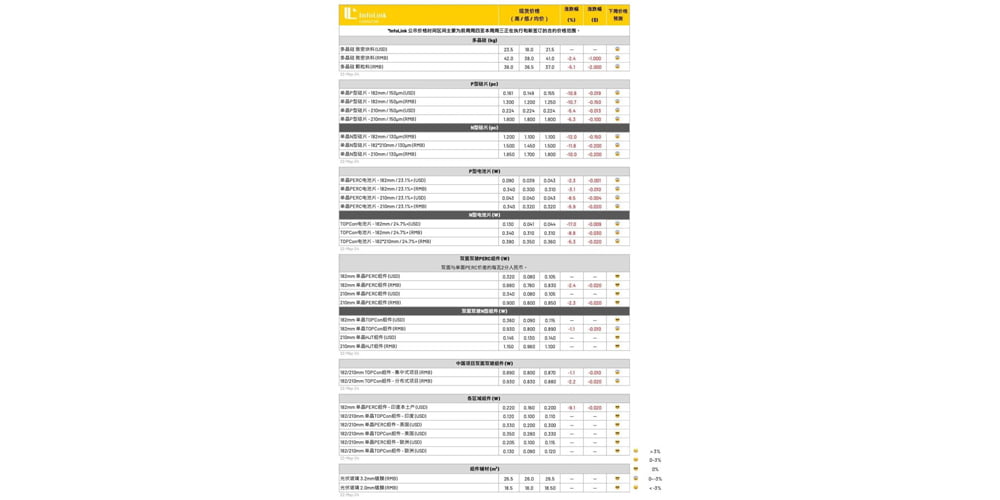

The overall atmosphere of the photovoltaic market is cold, with the bleak situation of continuous price declines in silicon material persisting without a halt for several weeks. This report observes mainstream market prices, where the price range for domestically produced dense block materials is between 38-42 RMB per kilogram, with an average level dropping to around 41 RMB per kilogram, a weekly decrease of 2.4%; the price range for domestically produced granular silicon falls within 36.5-38 RMB per kilogram, with an average level decreasing to around 37 RMB per kilogram, a weekly drop of 5.1%; for overseas origin silicon materials, the price range temporarily remains stable at 18-23.5 USD per kilogram. Considering the limited participation of enterprises from overseas producing regions and the presence of factors like a large proportion of long-term orders, the average price stands at around 21.5 USD per kilogram, maintaining temporary stability. This price corresponds to the mainstream market price trend; the USD value does not directly convert or equate to the RMB price.

The overall new supply volume of silicon materials on the supply side this month remains considerable. Although some manufacturers have begun to take actions to reduce production and conduct early maintenance, the intensity and determination have not been clearly shown yet. It is expected that the situation of large-scale production reduction may commence in the third quarter.

At the current price level, mainstream prices face the risk of falling below the price red line level of RMB 40 per kilogram. The price decline is gradually narrowing, with the downward momentum slowing down. However, if at the current price level the cash cost levels of various echelon enterprises are already breached, and there is no significant downward adjustment in the new supply level on the supply side, the silicon material inventory level by the end of the second quarter may approach an extremely high alert level close to three months of production.

Silicon Wafer Prices

Note: The size range for the 182mm silicon wafers includes prices for 182-183.72mm, with an anticipated update of specifications in June.

Silicon wafer prices continue to plummet due to fierce competition among companies, especially with the 183N specification experiencing a sharp decline. Apart from the top companies lowering their prices in a step-wise manner this week, it has been reported that the lowest price has dropped below 1.1 RMB per wafer.

This week, silicon wafer prices are still on a downward trend, with prices for P-type wafers in M10 and G12 sizes dropping to around 1.2-1.3 and 1.8 RMB per wafer respectively. Prices for N-type wafers in M10, G12, and G12R sizes have fallen to approximately 1.1-1.15, 1.8, and 1.45-1.5 RMB per wafer, with some sizes experiencing over a 10% decrease.

The silicon wafer segment is facing severe oversupply, reflected in current selling prices and inventory levels. Recently, silicon wafer manufacturers have begun to consider reducing production, with the actual impact depending on the absorption of inventory levels in this segment.

Battery Cell Prices

Note: The module size of 182mm refers to prices for sizes ranging from 182-183.72mm, with column descriptions expected to be updated simultaneously in June.

This week, battery cell prices continue to show a downward trend. P-type M10 sizes have slightly dropped to 0.31 RMB per watt, while G12 sizes saw a modest decline in transaction prices to around 0.32 RMB per watt. In the N-type battery cell sector, influenced by the decline in upstream silicon prices, M10TOPCon battery cell prices have further decreased, averaging around 0.31 RMB per watt. HJT (G12) battery cells with high efficiency have been priced between 0.55-0.6 RMB per watt. As for G12RTOPCon battery cells, current prices range from 0.36-0.38 RMB per watt.

It is worth noting that there is currently no price difference between TOPCon (M10) and PERC (M10) solar cells. In fact, based on the price trends of past iterative products, it is expected that the prices of M10 size N/P solar cells will reverse in the second half of the year.

In recent months, major module manufacturers have been continuously suppressing the prices of solar cell manufacturers through dual distribution and OEM cooperation. Coupled with the recent increase in silver prices, the profit margins of solar cells are continuously being squeezed. The OEM fee for M10N type solar cells is so low that it has even reached a level of 1.4 RMB per cell.

Component Prices

As supply chain prices continue to decline rapidly, project wait-and-see sentiment is increasing. Currently, domestic projects are mainly focused on collective procurement projects and commercial projects, while overseas demand is flat and European demand has been weak recently. Some component inventories have slightly increased, and it is not ruled out that the overall May capacity utilization rate may fall short of expectations, possibly extending into June. This week, the price of TOPCon components is approximately between 0.88-0.90 RMB, with project prices starting to move towards below 0.9 RMB. As for spot delivery this week, it has also followed the decline in battery prices, resulting in a significant price range between 0.83-0.93 RMB per watt. Recently, there has been competition for lower prices, leading to a rapid decline in the prices of low-efficiency products, with prices as low as 0.74-0.78 RMB per watt. However, these low prices will not be listed this week due to the exclusion of spot price samples from projects that do not follow normal efficiency and order patterns.

For other specifications, the price range of 182PERC double-glass modules is approximately 0.78-0.88 RMB per watt. There has been a significant reduction in domestic projects, driving prices toward 0.8-0.83 RMB per watt. Prices for low-efficiency products have rapidly decreased to around 0.71-0.75 RMB per watt. However, samples from spot market data will be excluded due to non-standard efficiency and ordering patterns, so the lower prices for this week are not listed. HJT modules have not seen many recent project deliveries, maintaining price stability at around 0.97-1.18 RMB per watt, with an average price nearing 1.1 RMB per watt and instances of prices below 1 RMB.

In terms of overseas prices, PERC prices are approximately 0.1-0.105 USD per watt.

The TOPCon prices show significant differentiation by region, with Europe and Australia having execution prices ranging from 0.10-0.13 Euros and 0.12-0.13 US dollars respectively. In markets like Brazil and the Middle East, prices fall within the range of approximately 0.10-0.12 US dollars, while in Latin America, prices range between 0.105-0.115 US dollars. Some manufacturers have reduced prices to as low as 0.09 US dollars in order to compete for orders.

HJT prices, on the other hand, have temporarily stabilized at around 0.13-0.15 US dollars per watt.

In the United States, second-quarter orders are limited, leading to a significant price differentiation in the market. Prices for PERC centralized projects are around 0.22-0.35 US dollars DDP, while TOPCon prices range from 0.23-0.36 US dollars DDP. Local manufacturers deliver distributed projects at prices ranging from 0.2-0.25 US dollars DDP.

Price Explanation

The InfoLink publicized price time interval mainly covers the contract price range executed and newly signed from the previous Thursday to the current Wednesday.

The spot price mainly references information from over 100 manufacturers. The most frequently traded “mode” data is used as the publicized price (not a weighted average), adjusted as needed based on the actual market conditions.

The polysilicon price in US dollars primarily reflects the price range of polysilicon from “non-China origin” in US dollars, not converted from RMB prices.

The price of solar cells in dollars is high, and the prices for PERC / TOPCon M10 size solar cells are mainly based on “Southeast Asian origin” solar cell prices.

In terms of components, the prices in Chinese Yuan are based on domestic demand quotations, with the average price mainly reflecting the ex-factory delivery price of the current week (excluding inland transportation costs). The main statistics cover distributed and centralized projects delivered during the current period, with high and low prices mainly reflecting the market conditions of second-tier manufacturers or some early-stage project prices; the prices in dollars are overseas prices outside China, quoted FOB without tariffs, and non-renminbi prices are converted.