The adjustment and optimization of the global energy structure is ongoing, and developing renewable energy and ensuring energy security has become the consensus of all countries. As an important component of renewable energy, photovoltaics also play a pivotal role in the adjustment and optimization of my country’s energy structure. China’s photovoltaic output value will reach 1.75 trillion yuan in 2023, and the installed photovoltaic power generation capacity has ranked first in the world for eight consecutive years. In the context of intensified industry competition and prominent geopolitics, how can Chinese photovoltaic companies break through?

In 2023, the global newly installed photovoltaic capacity will be 268 GW, a record high. China, the European Union and the United States are the three major markets driving global photovoltaic demand growth. China’s photovoltaic industry shows three characteristics: high industrial chain integrity, significant scale effect, and leading technological capabilities. However, the European Union and the United States are affected by multiple factors, and the overall development of their local photovoltaic industries is relatively slow.

Throughout the development history of China’s photovoltaic industry, from the beginning as the “world’s photovoltaic industry foundry” to today’s leading the world and global layout, to future global win-win cooperation, Chinese photovoltaic companies have been running forward at an “acceleration”. During this process, we also encountered a series of problems and challenges.

Returning to their roots, Chinese photovoltaic companies can only remain invincible in the changing external situation and fierce industry competition by continuously enhancing their core competitiveness. Excellent technical capabilities, first-class operation and management capabilities, and strong supply chain management capabilities are the foundation for Chinese photovoltaic companies to gain a foothold on the world stage.

1. A quick overview of the global photovoltaic market

Introduction phrase: Energy revolution trends forward, and countries increase support

Since the beginning of the 21st century, solar energy has further attracted the attention and application of the global community. This is mainly driven by two major factors. First, the two main themes of global “carbon neutrality” and “energy revolution” continue to drive the growth of clean energy demand; second, the photovoltaic levelized cost of electricity (LCOE) continues to decline, and the economic efficiency has been greatly improved.

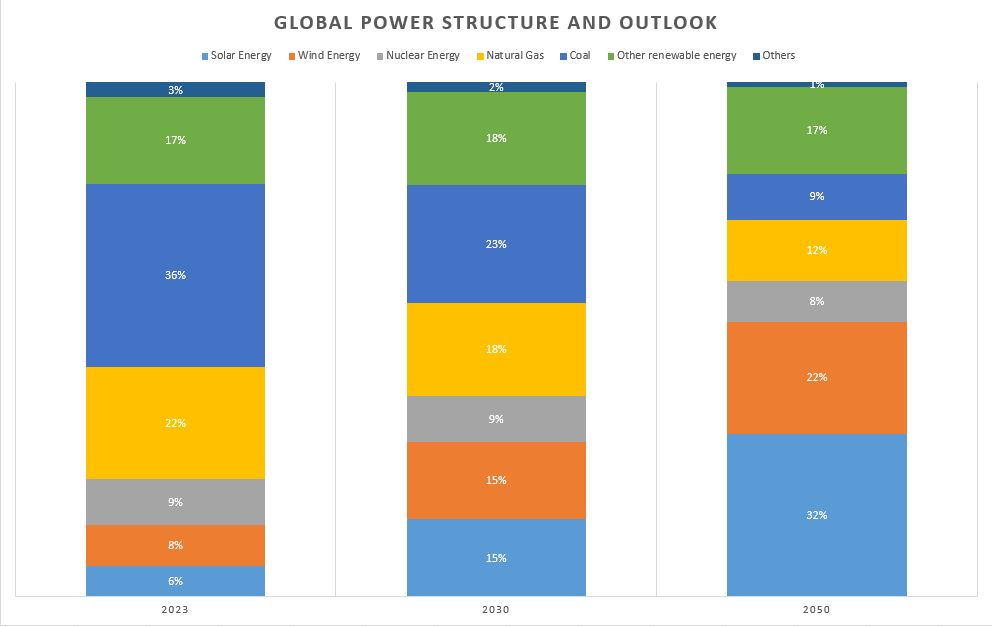

Looking at the global power structure, in 2023, the three traditional energy sources of oil, coal and natural gas will still dominate, accounting for as much as 61%, and renewable energy will account for about 39%, of which solar power generation will account for only 6%. The global power structure is facing profound changes. According to the International Energy Agency (IEA), by 2030, the dominant position of traditional energy power generation will be challenged; by 2050, renewable energy will become the main force of the power structure, accounting for as much as 79%, of which solar power generation is expected to reach 32%.

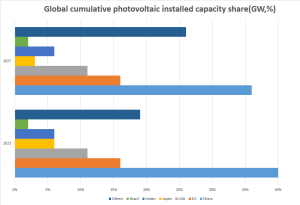

According to data from the European Photovoltaic Association (SPE), the total global photovoltaic installed capacity has reached 1,624 GW in 2023. Under the medium scenario forecast, the total global installed capacity will increase significantly to 3,532 GW in 2027, with a compound growth rate of as high as 21 %. From a regional perspective, China ranks first in the world with a cumulative installed photovoltaic capacity of 656 GW in 2023, accounting for 40%, followed by the EU and the United States, with installed capacities of 263 GW and 173 GW respectively. According to the European Photovoltaic Society (SPE), the global photovoltaic installed capacity pattern is expected to remain unchanged by 2027. It is worth noting that in the past few years, the growth rate of photovoltaic installed capacity in China, the United States and Brazil has exceeded the global average growth rate of 27%. Among them, the growth rate of Brazilian photovoltaic has reached 74% due to its small installed capacity base. amazing speed.

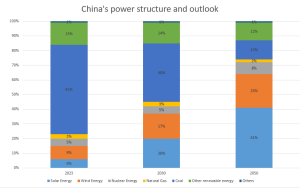

China

In 2023, traditional energy generation will account for 65% of China’s power supply structure, renewable energy generation will account for 35%, of which photovoltaic power generation will account for only 6%. According to the International Energy Agency (IEA), 76% of electricity supply will come from renewable energy in 2050, of which photovoltaic power generation will account for 41%. By then, photovoltaic power will become one of the core forces for China to build a new power system dominated by new energy.

China has world-leading technical strength, a complete production and manufacturing system, and rich industry experience in the field of photovoltaics. China’s production capacity and output in many core links of the photovoltaic industry chain account for more than 80% of the world, showing the fault-like advantage of China’s photovoltaic industry chain.

Facing the current development stage of the photovoltaic industry, the policy orientation has shifted from direct subsidies to promoting high-quality development of the industry to solve the pain points currently faced by the industry. These include: First, policy guidance to improve the level of green electricity application and promote the deep integration of photovoltaics with other industries to effectively solve the problem of electricity consumption; second, in response to the unclear revenue model, the introduction of electricity reform policies to promote photovoltaics to accelerate their entry into electricity market transactions, while actively exploring new project revenue models, such as the transformation of distributed photovoltaic business models to electricity sales services and load aggregation services; third, guidance on the regional construction of photovoltaics, such as encouraging the construction of offshore photovoltaic power stations in coastal areas and large-scale wind and solar bases in desert Gobi areas, to solve the problem of limited land use.

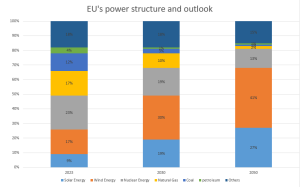

EU

As a global leader in addressing climate change and the source of photovoltaic technology, the EU has demonstrated outstanding performance in the field of renewable energy. In 2023, the total installed photovoltaic capacity of the EU reached 263 GW, ranking second in the world. In the EU’s power supply structure, renewable energy power generation accounts for as much as 67%, of which photovoltaic power generation accounts for 9%. According to the International Energy Agency (IEA), by 2030, the proportion of renewable energy power generation will further increase to 86%, while the proportion of photovoltaic power generation is expected to increase to 19%, and by 2050, the proportion of photovoltaic power generation is expected to further increase to 27%.

However, the EU’s stringent environmental protection requirements, high production costs and lack of policy support have constrained the development of its photovoltaic industry to a certain extent. For example, in the silicon wafer and battery segment, the EU accounts for less than 1% of the global market share. At present, the EU mainly relies on imports in the photovoltaic industry, and more than 90% of solar photovoltaic wafers and other photovoltaic technology components come from China.

In order to support the development of local photovoltaic companies, the EU has formulated a series of policy measures in recent years. In terms of technological development, it launched the “European Affordable, Secure and Sustainable Energy Joint Action Plan”, and plans to invest an additional 210 billion euros in breakthroughs in key clean energy technologies by 2027. In terms of supporting local companies, the “Net Zero Industry Act” was implemented, setting a goal of at least 40% of clean energy technology demand to be met by EU domestic production by 2030, and proposing that if third-country products account for more than 65% of the EU market share, third-country suppliers will be restricted .

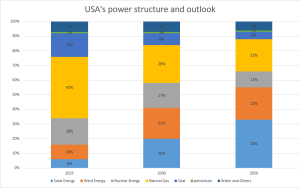

USA

As a major energy country dominated by oil and gas, in 2023, traditional energy generation accounted for 59% of the US power supply structure, new energy generation accounted for 41%, and photovoltaic power generation accounted for only 6%. This is still a long way from the goal of achieving carbon-free power generation by 2035 as proposed in the US “3550” plan[2]. For the United States, the development of photovoltaics is an important part of its energy structure adjustment and a necessary means to further consolidate its position as an energy power. According to the US Energy Administration (EIA), by 2030, 66% of electricity supply will come from new energy, of which photovoltaics will account for 20%. By 2050, 73% of electricity supply will come from new energy, of which photovoltaics will account for 33%.

The United States has a considerable scale and development potential in the field of photovoltaic installation, but at present, its local photovoltaic enterprises cannot meet the market demand for photovoltaic products. According to the US Solar Energy Industries Association (SEIA) and Solar Power World, the United States will only have 60,000 tons of production capacity in the silicon material link in 2023, and all of them will be idle; there will be almost no production capacity in the silicon wafer and battery production links; the component link capacity in the first quarter of 2024 will be about 26 GW. Overall, the development of the domestic photovoltaic industry in the United States is relatively slow.

In order to support the development of domestic photovoltaic enterprises in the United States, on the one hand, in addition to anti-dumping and anti-subsidy actions, the United States has successively adopted a series of measures to curb China’s photovoltaic exports, including the implementation of 201 regulations and 301 regulations; on the other hand, the United States has promulgated the Inflation Reduction Act, which plans to invest $369 billion to address climate change and enhance energy security. In addition, it has proposed incentive policies covering all aspects of the photovoltaic industry, including production tax credits (PTC), investment tax credits (ITC), advanced manufacturing production tax credits, and direct manufacturing subsidies.

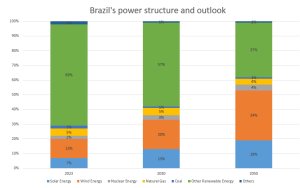

Brazil

About 89% of Brazil’s electricity comes from renewable energy. According to the International Energy Agency (IEA), this proportion will increase to 92% by 2050, of which photovoltaic power generation will account for 19%. In the past decade, favorable tax reduction and net metering policies[3], rising electricity prices[4] and falling prices of photovoltaic modules have driven the rapid development of Brazil’s photovoltaic industry from scratch. The installed capacity has increased from 8 MW in 2013 to 39 GW, making it the third largest country in the world in terms of new photovoltaic installed capacity and the sixth largest country in terms of cumulative installed capacity in 2023. Brazil is located in a tropical climate zone with abundant sunlight resources, making it one of the most promising photovoltaic markets in Latin America.

Brazil’s photovoltaic industry chain is weak and requires a large amount of imports to meet market demand. The country lacks mid- and upper-stream silicon materials, silicon wafers, batteries and other industrial links, and the photovoltaic module production capacity is less than [5] GW. 99% of photovoltaic module imports come from China. Therefore, Brazil’s energy transformation will still rely on China’s photovoltaic industry for a long time.

Brazilian Vice President Alckmin said that achieving local production of solar power generation equipment is of strategic significance and will be conducive to Brazil’s energy security and low-carbon economic transformation. In order to encourage the development of the local photovoltaic industry, Brazil has begun to restrict imports. In December 2023, the Brazilian Foreign Trade Commission Management Executive Committee (GECEX) decided to impose import taxes on solar panels and resume import taxes on 324 related products to promote the development of the domestic renewable energy industry. In addition, the government plans to attract more than 300 billion reais (about 60 billion US dollars) of investment for power point construction between 2020 and 2030, of which photovoltaic and wind power new investment accounts for more than 50%.

2. Development history of China’s photovoltaic industry

Introduction phrase: China’s photovoltaic industry has experienced twists and turns and “emerged as a butterfly” in the changing situation.

Industry start-up and low-end expansion stage (2000-2010)

In the early 20th century, European countries increased their support for the photovoltaic industry at the policy level, thus stimulating people’s demand for solar energy. Developed countries transferred the silicon material link with the highest energy consumption and the most serious pollution in the photovoltaic industry, as well as the assembly link that requires a lot of manpower, to foreign countries. During this stage, Chinese companies opened the era of photovoltaic industry OEM with the advantage of cheap and abundant local labor. In just a few years, China has become the world’s largest producer in the field of photovoltaic modules. However, behind this prosperity lies a huge crisis. The technical content and added value of Chinese photovoltaic companies’ products are low, and due to the insufficient demand in my country’s photovoltaic market, the products they produce are mainly exported to generate income. China’s photovoltaic industry is actually facing the dilemma of being restricted by people in terms of raw materials, technology, equipment and market.

Industry reshaping and transformation fast-running stage (2011-2020)

In 2011, the European debt crisis broke out, and subsidies for the photovoltaic industry in major countries decreased, and the photovoltaic market shrank rapidly. The subsequent “double anti-dumping” measures by Europe and the United States have once again impacted my country’s photovoltaic enterprises, causing a large number of enterprises to go bankrupt or fall into a survival crisis. China’s photovoltaic industry has experienced pain and reshuffle. In order to cope with the blockade of Chinese enterprises by Europe and the United States and reawaken the vitality of China’s photovoltaic industry, the Chinese government has actively promoted the development of the local photovoltaic market, standardized the industry order, and improved financial policies to support technology upgrades from the policy level. At the same time, in order to change the situation that China has always been at the bottom of the global photovoltaic value chain, Chinese photovoltaic enterprises have begun to focus on research and development and absorb and improve foreign advanced technologies. In this process, a number of representative enterprises have emerged to reshape the new pattern of China’s photovoltaic industry. At this stage, with the help of policy guidance, China’s photovoltaic domestic demand market has exploded, the photovoltaic industry has formed a scale effect, and photovoltaic enterprises have accumulated technological advantages. my country’s cumulative photovoltaic installed capacity has achieved a great leap, from only 3.1 gigawatts in 2011 to more than 250 gigawatts in 2020, surpassing Europe and the United States and becoming the world’s largest photovoltaic industry country.

High-quality development and global layout stage (2021-2025)

Looking inward, 2021 is the first year for the implementation of the “dual carbon” goal after it was proposed. The photovoltaic industry has policy support, technical support, and market demand. At the same time, with the rapid rise of new-generation information technology represented by 5G communications and industrial Internet, the photovoltaic industry is innovating and upgrading in the direction of digitalization. Looking outward, since 2021, the trend of deglobalization has intensified, international trade frictions have occurred frequently, and Europe, the United States, India and other countries have repeatedly imposed trade restrictions on China, such as the US anti-circumvention investigation and India’s anti-dumping investigation. Coupled with the severe form of “involution”, photovoltaic companies have chosen to increase overseas investment and factory construction, and gradually realize the global “research, production, supply and marketing” integration, and transform and upgrade from “made in China, sold globally” to “made globally, sold globally”. In this process, the United States and Southeast Asia have become investment hotspots, and investment in emerging markets such as India and the Middle East has also continued to heat up.

Technology-led and win-win cooperation stage (2026-future)

Under the challenge of geopolitics, the restrictions on simple product exports and overseas factory construction will increase, and Chinese photovoltaic companies must seek diversified overseas routes. For example, adopting a technology licensing service model to help other countries build their own factories locally. Relying on the experience and capabilities accumulated in technology, production, management, brand, and service, Chinese photovoltaic companies have created a light-asset overseas model and built a win-win cooperation ecosystem on a global scale. This is the general trend of the future “globalization” development of the photovoltaic industry.

Looking back over the past two decades, China’s photovoltaic industry has made great progress in ups and downs, and has achieved a transformation from being controlled by others to being self-controlled, from catching up to leading the world. Now China’s photovoltaic industry is striding forward to a new journey. However, behind the industry’s big strides, it is also necessary to pay attention to the problems and challenges encountered by China’s photovoltaic industry in the process of development.

► First, there are many players in China’s photovoltaic industry, and the industry is in a state of overcapacity as a whole, and the industry is stuck in the quagmire of “price war”. According to Qichacha data, the cumulative number of registered photovoltaic-related enterprises in my country in 2023 is about 900,000, and the compound growth rate of the number of enterprises in the past ten years is as high as 52%. According to the International Energy Agency (IEA) and InfoLink forecast, the global photovoltaic module production capacity will exceed 1,120 GW in 2024, of which China accounts for about 80%, and the global photovoltaic module demand forecast scale in 2024 is 500-550 GW. According to the data of the Ministry of Industry and Information Technology, from January to December 2023, the price of polysilicon and module products fell by more than 50%.

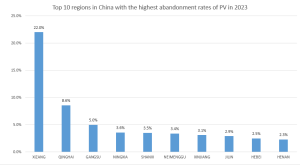

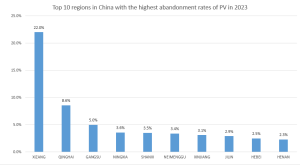

Second, the problem of China’s new energy consumption is becoming increasingly prominent. The distribution of my country’s photovoltaic bases and load centers is inconsistent, giving rise to the demand for long-distance power transmission. Due to the pressure on the power transmission channel and the insufficient regulation capacity of the power system, the phenomenon of abandoned light is still serious. Although the national abandonment rate is only 2% overall, the abandonment rates in Tibet, Qinghai and Gansu have reached 22%, 8.6% and 5% respectively. Although the government has launched a large number of UHV and other power transmission channel construction projects, and carried out a series of reforms from the power market side, such as improving the medium- and long-term power and spot markets, power auxiliary service markets, green electricity and green certificate trading systems and related market construction, it will still take a long time to be effective.

Third, Europe, the United States and other countries have set up trade barriers against Chinese photovoltaic products. Since launching the anti-dumping and countervailing actions, the United States has successively adopted tariff measures such as Section 201 and Section 301 investigations to curb the export of my country’s photovoltaic products. The European Union followed suit and promulgated the Net Zero Industrial Act [5] and the Regulation on the Prohibition of Forced Labor Products on the EU Market.

► Fourth, the European Union has built invisible “green barriers” against Chinese photovoltaic companies. Compared with the European Union, under the same conditions, the carbon emissions of Chinese photovoltaic products are relatively high. If the European Union’s Carbon Border Adjustment Mechanism (CBAM) is expanded to photovoltaic products, it will directly affect the export of silicon materials with high carbon emissions. In addition, the French Energy Regulatory Commission (CRE) has included the carbon footprint emissions of photovoltaic modules in the evaluation indicators in photovoltaic bidding, and this behavior has gradually been promoted in other EU countries.

III. The core competitiveness of Chinese photovoltaic companies

Introduction phrase: The iron must be hard to forge, the compulsory “internal strength” of photovoltaic companies

Faced with multiple challenges at home and abroad, for Chinese photovoltaic companies, cultivating internal strength is the hard truth. So, as a photovoltaic company, what internal strength do you need to cultivate?

Photovoltaic enterprise capability assessment framework

A Hard power

“Technical capability”

1. R&D capability

·R&D investment level and number of R&D results

·R&D innovation strength and advanced technology reserves

2. Product capability

·Product performance advantage

·Product quality and safety

B Soft power

“Business management capability”

3. Operation capability

·Resource allocation capability

·Plan execution and analysis capability

4. Financial capability

·Fund operation capability

·Cost control level

5. Market capability

·Brand building capability

·Customer relationship and service operation

6. Organization capability

·Corporate governance capability

·Core team building

C Ecological power

“Supply chain management capability”

7. Ecological power

·Supply chain security and stability capability, including ecological cooperation capability, core resource control capability and upstream and downstream layout capability of the industrial chain

·Supply chain lean management capability, using digital and intelligent empowerment to improve the flexibility and agility of the supply chain and achieve cost reduction and efficiency improvement

After the reshuffle of the photovoltaic industry and the joint restrictions by Europe and the United States, China’s photovoltaic industry has shifted from competing in scale and price to competing in quality and efficiency, returning to its technological roots. Based on Dadong Times’ interviews with technical experts from leading photovoltaic companies, combined with industry accumulation and experience, we have summarized the top ten technological trends in the photovoltaic industry in the future.

Top 10 future technology trends in the photovoltaic industry

Trend 1: Large-size silicon wafers are in line with future technology trends

Trend 2: In terms of perovskite cells, multiple efficiency improvement paths are parallel in the short term, and full perovskite stacking opens the efficiency ceiling in the long term

Trend 3: N-type silicon wafers + (ultra) thin film trends continue to advance

Trend 4: In the graphic route, wet film + projection mask lithography is the future mainstream

Trend 5: Tubular PECVD coating process and aluminum oxide three-in-one process are expected to become mainstream

Trend 6: In terms of thin-film battery substrate materials, FTO + online coating is the future mainstream route

Trend 7: Thanks to better optical and electrical properties, microcrystallization can further improve HJT efficiency

Trend 8: At present, research on sputtering targets is moving towards diversification, high purity, and large-scale. In the future, low indium is the core route

Trend 9: 0BB, electroplated copper, and silver-clad copper go hand in hand to help low silver

Trend 10: The manufacturing process of photovoltaic cells is developing towards digitalization

The technological iteration and update of the photovoltaic industry is still accelerating, so the first level of “internal strength” that enterprises need to cultivate is the hard power of the enterprise, that is, technical capabilities.

In the past, Chinese photovoltaic enterprises achieved extensive expansion by relying on human resources and policy support, but ignored the soft power of the enterprise itself, that is, the improvement of business management capabilities, including operation management, financial management, market management and organizational management. Nowadays, Chinese photovoltaic enterprises have carried out global layout, and the requirements for their business management capabilities and risk control capabilities throughout the process have also increased. Therefore, improving global business management capabilities is a compulsory course for the long-term development of Chinese photovoltaic enterprises.

In the new development stage of realizing “global cooperation and win-win” for Chinese photovoltaic enterprises, what is tested is not only the technology and business capabilities of enterprises, but also the supply chain competitiveness from the supply side, manufacturing side to the customer side. On the one hand, supply chain competitiveness refers to the ability of enterprises to maintain the security and stability of their own supply chains in the face of risks such as geopolitics and policy barriers of various countries, including ecological cooperation capabilities, core resource control capabilities and upstream and downstream layout capabilities of the industrial chain; on the other hand, it refers to the lean management capabilities in the supply chain, such as through digitalization and intelligent empowerment, to improve the flexibility and agility of the supply chain and achieve cost reduction and efficiency improvement.

For photovoltaic enterprises, how to cultivate solid internal strength and hone strong skills is the key to achieving sustainable and high-quality development. Hanfysolar can rely on its profound industry knowledge, rich industry experience, comprehensive business capabilities and global resource network to provide impetus for its own enterprise transformation and upgrading and in-depth changes, deeply cultivate the customization and application product development of small components in the segmented market, and help photovoltaic companies achieve sustainable development.

Amid the changing situation, the development of China’s photovoltaic industry has reached a critical moment. Chinese companies must practice internal skills, strengthen their foundation, build core competitiveness, and construct a photovoltaic industry ecosystem in order to achieve sustainable and high-quality development of China’s photovoltaic industry.