1. Efficiency:

The United States led the development of photovoltaic solar energy technology and industrialization in the first stage. In 1954, the first solar cell was born in Bell Labs in the United States, with a cell conversion efficiency of 6%. The New York Times published an article: “It may mark the beginning of a new era, and finally realize one of mankind’s most cherished dreams – using almost unlimited solar energy to serve human culture.” After that, the conversion efficiency continued to increase, reaching 9% in 1955 and breaking through 14% in 1960.

In terms of industrialization, due to the high cost of early photovoltaics, solar energy was mainly used in space projects at that time. From 1958 to 1969, the US space project spent a total of about US$50 million and purchased 10 million solar cells.

In 1973, due to the oil embargo, the United States held the “Cherry Hill Conference” to formulate photovoltaic development goals, intending to invest US$250 million in photovoltaic research and development from 1975 to 1985. In fact, the United States invested US$1.7 billion in photovoltaic research and development from 1974 to 1981 alone.

In the early 1980s, the sales of American photovoltaic companies accounted for 85% of the global photovoltaic market. However, in 1981, Reagan, who supported nuclear energy, was elected president and drastically cut the photovoltaic research and development budget. In 1985, oil production was in excess and prices plummeted. “Energy independence” was no longer a worrying issue, and the United States systematically canceled various photovoltaic development plans.

The United States’ contribution to photovoltaics: From 1954 to 2004, 14 of the 20 most important technological breakthroughs in the photovoltaic industry appeared between 1974 and 1981, and almost all of them were born in the United States.

In my country, in 2000, Shi Zhengrong returned to China to establish Suntech Power, and then the domestic business community began to develop the photovoltaic industry on a large scale. In September 2002, Suntech’s first 10MW solar cell production line was completed and put into production, and the conversion efficiency of photovoltaic modules reached 15%.

In November 2005, Merkel came to power in Germany and supported domestic photovoltaic companies. Products with a conversion efficiency of less than 16% could not enter the German market, and many Chinese companies have not yet reached the level required by Germany.

In 2007, the conversion efficiency of monocrystalline silicon cells of leading domestic enterprises averaged 16.7%, with a maximum of 17.7%, while the highest level abroad reached 24%.

2013: “Several Opinions of the State Council on Promoting the Healthy Development of the Photovoltaic Industry”: The conversion efficiency of monocrystalline cells in new photovoltaic manufacturing projects shall not be less than 20%, polycrystalline shall not be less than 18%, and thin film shall not be less than 12%. [At that time, the efficiency of monocrystalline cells was mostly between 19% and 19.5%]

In 2023, the conversion efficiency of advanced photovoltaic cells in mass production in China will be around 25%.

——[The efficiency of mass-produced photovoltaic cells in my country: from Suntech’s 15% in 2002 to 19.5% in 2013 and 25% in 2023, the battery conversion efficiency has improved by about 0.48% every year; in 1990, the efficiency of the crystalline silicon solar laboratory led by Professor Martin Green of the University of New South Wales in Australia, where Shi Zhengrong studied abroad, reached 23%. From 1954 to 1990, it rose from 6% to 23%, with an annual increase of about 0.47%. ]

2. Production and sales volume:

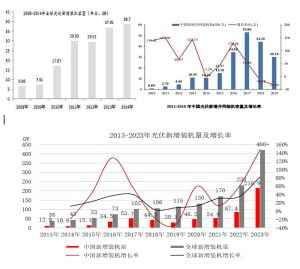

In the early 1990s, the annual output of photovoltaic cells in the world was nearly 50MW. In 1997, the annual output exceeded 100MW for the first time. In 1998, the global output of polycrystalline silicon cells was 79.9MW and the output of monocrystalline silicon cells was 75MW. In 2000, the global output of solar cells was 287.65MW, of which Japan accounted for 44.7% of the market share with 128.6MW. In 2002, it exceeded 500MW, and in 2004 it exceeded 1GW. In 2006, the world’s solar cell output reached 2.5GW. In 2022, the global photovoltaic installed capacity will be 230GW, and in 2023 it will be 444GW.

3: Price and cost

1: Cost per kilowatt-hour:

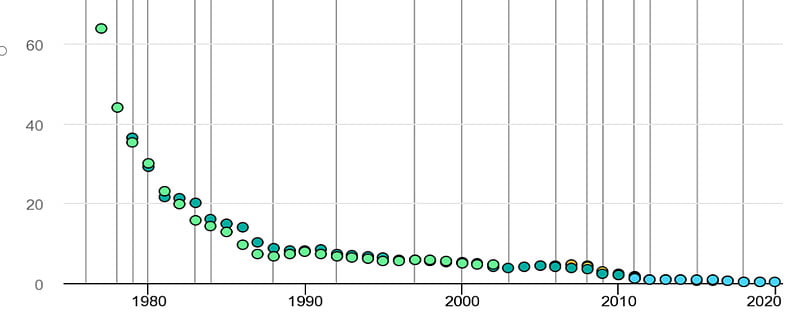

In the 1950s, the cost per kilowatt-hour of the first batch of photovoltaic power generation systems was as high as US$300/kilowatt-hour, while the current lowest electricity price has dropped to US$0.0104/kilowatt-hour (i.e. 1.04 cents, from the winning bid price of the Saudi Arabian photovoltaic project in April 2021), which is only one-thirtieth of the initial level.

– If it is divided into a ten-year stage, it will drop by about 77.3% every ten years, that is, the cost per kilowatt-hour ten years later is only 1/4.4=22.7% of that ten years ago. The annualized decline is about 14%.

In 2007 and 2008, the National Development and Reform Commission approved four photovoltaic power station projects twice, including: 2 in Shanghai, 1 each in Inner Mongolia and Ningxia, and the approved on-grid electricity price was 4 yuan/kilowatt-hour (the on-grid electricity price of wind power in that year was 0.51-0.61 yuan/kilowatt-hour).

In 2017, the benchmark price of photovoltaic power in my country was 0.85 yuan/kilowatt-hour. In 2022, the average on-grid electricity price of photovoltaic power generation in China will be 0.38 yuan/kWh.

— From 2008 to 2022, it fell from 4 to 0.38 in 14 years, with an annualized decline of about 15%.

2: System cost:

In 2007 and 2008, the system price of domestic grid-connected photovoltaic power stations remained at 50-60 yuan/W.

It reached about 35 yuan/W in 2009 and about 25 yuan/W in 2010. In 2023, the initial total investment cost of my country’s ground photovoltaic system was about 3.4 yuan/W.

— From 2008 to 2023, it fell from 55 to 3.4 in 15 years, with an annualized decline of about 16%.

3: Component price:

Japan: In 1986, Japan built a 1,000-kilowatt photovoltaic demonstration power station with a component cost of 1,000 yen/watt. From the early 1970s to 1997, Japan’s Sunshine Project took more than 20 years to reduce the manufacturing cost of solar cells from 20,000-30,000 yen/watt to 600 yen/watt.

In the late 1990s, the cost of domestic components in China was as high as 35 yuan/watt, and the average selling price was 44 yuan/watt, both higher than imported products.

In September 2002, Suntech’s first 10MW solar cell production line was completed and put into production, with a cost of 3.28 US dollars/watt and a selling price of 3.48 US dollars/watt. In December 2003, the second 15MW production line was put into production, using a large number of domestic equipment. The production line cost was only one-third of the first one, and the component price was: 2.8 US dollars/watt.

In 2009, for the 10MW photovoltaic demonstration project in Dunhuang, Gansu, CGN purchased Yingli modules at 9 yuan/watt, and the project was completed and connected to the grid in October 2010.

The average price of Suntech products dropped from 3.89 US dollars/watt in 2008 to 2.4 US dollars/watt in 2009, and then to 1.82 US dollars/watt in 2010.

From March to December 2011, the average spot price of modules fell from 1.62 US dollars/watt to 0.924 US dollars/watt.

2012: The bidding price of domestic projects was generally lower than 3.9 yuan/watt.

In 2013, China promised to export photovoltaic modules to Europe at a price of no less than 0.56 euros/watt, which was about 4.4 yuan/watt at the exchange rate at that time.

In 2017, the module price was 3 yuan/watt. In 2023, the module price will reach the 1 yuan/watt mark.

——From 2008 to 2023, the price fell from $3.5 to $0.15 in 15 years, with an annualized decline of about 18%

4: Cost and price of polysilicon

In 2000, the import price of polysilicon was US$9/kg; in the following two or three years, the demand for photovoltaic-grade polysilicon grew slowly, and the price rose steadily, but basically remained at US$20-30/kg, reaching US$80/kg at the end of 2005; in 2006, it exceeded US$100/kg. In 2007, the market price exceeded US$300/kg; in 2008, the price peaked at US$500 per kilogram.

In 2009, the spot price of polysilicon was US$60-70/kg, while the domestic cost was generally US$50-70/kg.

In 2010, SDIC produced 5,052 tons of polysilicon at a price of $59.64 per kilogram. In 2011, it produced 10,455 tons at a price of $56.46 per kilogram. In 2012, it produced 2,520 tons at a price of $26.05 per kilogram.

In December 2011, the price fell below $30 per kilogram, and soon after, it fell to $16 per kilogram.

In July 2012, the price of polysilicon was $22 per kilogram, and at the end of the year it reached $15 per kilogram. SDIC’s production cost was $38 per kilogram.

The price of polysilicon in 2014: 151 yuan per kilogram.

In 2015, the cost of polysilicon in China was $11 per kilogram, slightly lower than the $12 per kilogram of overseas polysilicon leading companies in 2004.

In 2023, the cost of polysilicon in China will be around 45 yuan/kg. From 2009 to 2023, the cost will drop from 385 yuan/kg to 45 yuan/kg in 14 years, with an annualized decline of about 14%.

IV: 2005-2008: The first photovoltaic boom period

From 2005 to 2008, the price of photovoltaic modules did not change much. The module price in 2005 was about 3.6 US dollars/watt, and the module price in 2008 was about 3.49 US dollars/watt.

In 2005, each watt of module required about 0.012 kg of polysilicon. When the price of polysilicon in 2005 was $50/kg, the corresponding module polysilicon cost was $0.6/W.

In 2008, each watt of module required about 0.008 kg of polysilicon. When the price of polysilicon in 2008 was $400/kg, the corresponding module polysilicon cost was $3.2/W.

The surge in polysilicon prices has greatly increased the cost of components.

Due to the introduction of domestic equipment, the cost of domestic photovoltaic enterprises has been greatly reduced, but due to the sharp increase in the price of upstream raw material polysilicon, the gross profit margin of my country’s photovoltaic enterprises has actually declined sharply.

For example, Suntech: In September 2002, Suntech’s first 10MW solar cell production line was completed and put into production, with a cost of US$3.28/watt and a selling price of US$3.48/watt. In December 2003, the second 15MW production line was put into production, using a large number of domestic equipment. The production line cost was only one-third of the first one, and the selling price was US$2.8/watt.

From the end of 2005 to the second half of 2006, the production cost of Chinese photovoltaic enterprises increased by more than 50%, and the profit of photovoltaic components fell from 25% to less than 10%.

V: The past and future prospects of the photovoltaic industry

The last round of prosperity in the photovoltaic industry was in 2008. At the beginning of 2008, the price of photovoltaic modules was about 24 yuan/watt. In 2008, the global photovoltaic installed capacity increased by 6.7GW, and the output value of the newly installed photovoltaic modules was 160 billion yuan. Twelve years later, in 2020, the global photovoltaic installed capacity increased by 130GW, the price of photovoltaic modules was about 1.6 yuan/watt, and the output value of modules was 208 billion yuan, an increase of 30% in 12 years, and an annualized growth rate of 2.1%, which is almost negligible.

The so-called photovoltaic industry is a fast-growing industry is just an illusion. The plummeting product prices have wiped out the surge in quantity.

In 2008, the total production capacity of the world’s top 10 solar manufacturers reached 3620.2MW, accounting for 52.8% of the global total. In 2008, the global total production of solar cells was 6850MW. Germany’s Q-Cells has become the world’s leading solar cell company with a production capacity of 574.2MW, followed by the United States’ First Solar, China’s Wuxi Suntech, Japan’s Sharp, Japan’s Kyocera, China’s Tianwei Yingli, China’s JA Solar, Taiwan’s Motech, the United States SUN POWER, Japan’s Sanyo, with production capacities of 503MW, 497.5MW, 473MW, 290MW, 281.5MW, 277MW, 272MW, 237MW, and 215MW respectively.

The ranking of global photovoltaic module shipments in 2020 is: Longi, JinkoSolar, Trina Solar, JA Solar, Canadian Solar, Hanwha, Risen Energy, First Solar, Chint, and Suntech.

At the peak in early 2008, Suntech’s market value was 70 billion, Yingli’s was 52.8 billion, and JA Solar’s was 44 billion [roughly converted at an exchange rate of 7]. In 2020, excluding Longi, the third-ranked Trina Solar was 45 billion, followed by JA Solar Technology’s 65 billion, and Risen Energy’s was 26 billion. This is the market value after the surge. In 2019, the market value was even pitiful.

In the more than ten years from 2008 to 2019, under the premise of a significant increase in industry concentration, the revenue of the leading photovoltaic companies has increased significantly, but the net profit and market value have not yet broken through the previous highs.

The trough of the photovoltaic industry after 2008 was not a few years, but more than a decade. The entire industry struggled between a small profit and a loss. Apart from Suntech, Yingli, and LDK, the stock price trends of other photovoltaic companies are basically hard to describe! The only good thing may be that foreign photovoltaic companies have been killed. In 2008, Suntech could barely rank third in the world. By 2020, only Hanwha and First Solar could barely enter the top ten in the industry. The photovoltaic companies that were eliminated in my country: Suntech, Yingli, and LDK are all without exception. The main reason is that they blindly entered the upstream silicon material industry when silicon materials were at a high point. Yingli and LDK produced silicon materials by themselves, while Suntech entered the silicon material production link and signed long-term orders for silicon materials in a joint venture with others. For details, see the background information below.

In the development of the photovoltaic industry, photovoltaic equipment plays an important role. Even when the industry is booming, laymen without technical accumulation can quickly enter the photovoltaic industry with the whole line solution and “turnkey project” service of photovoltaic production equipment, and earn good profits in a short period of time. For example, during the booming period of the industry from 2005 to 2008, the leading company Suntech would purchase individual equipment piecemeal to reduce costs, and then modify and debug these equipment by themselves to form a production line, while later companies simply purchased complete sets of equipment and purchased “turnkey” engineering “one-stop” production lines, from battery production to equipment components. After Suntech, some Chinese photovoltaic companies expanded their production capacity from 0 to 100MW in less than two years, while Suntech took 5 years to expand its production capacity.

I don’t know if this is a unique feature of the photovoltaic industry, or if the development process of other manufacturing industries is similar to it?

In the more than ten years of the industry’s downturn, it seems that the only exception is Longi, which not only has a high-speed growth in revenue, but also has a net profit margin that almost crushes a number of photovoltaic companies before 2020.

Longi’s exception should be attributed to: deep cultivation of monocrystalline, early realization of diamond wire and PERC battery technology, and relying on the financing advantages of A-shares. After 2020, the technology quickly popularized, some foreign-listed photovoltaic companies returned to A-shares and raised large-scale financing to expand production. Encouraged by the large-scale development brought by grid parity, some other industries also entered the photovoltaic industry. Longi’s advantages no longer exist, and Longi has slowed down the expansion speed, recovered funds, and its revenue was caught up by competitors. Can Longi’s all-in BC technology now replicate the legend? Wait and see!

Will the trough of the photovoltaic industry this time last for more than ten years like before?

However, it can be predicted that the price of the photovoltaic industry will not drop as much as before in the future, but the installation volume will not increase as much as before. The overall output value of the photovoltaic industry, even if it increases, is very limited. The probability of relying on the prosperity of the industry to obtain good returns is very low. Whoever can replicate Longi’s path in the past few years can become a target worth investing in.