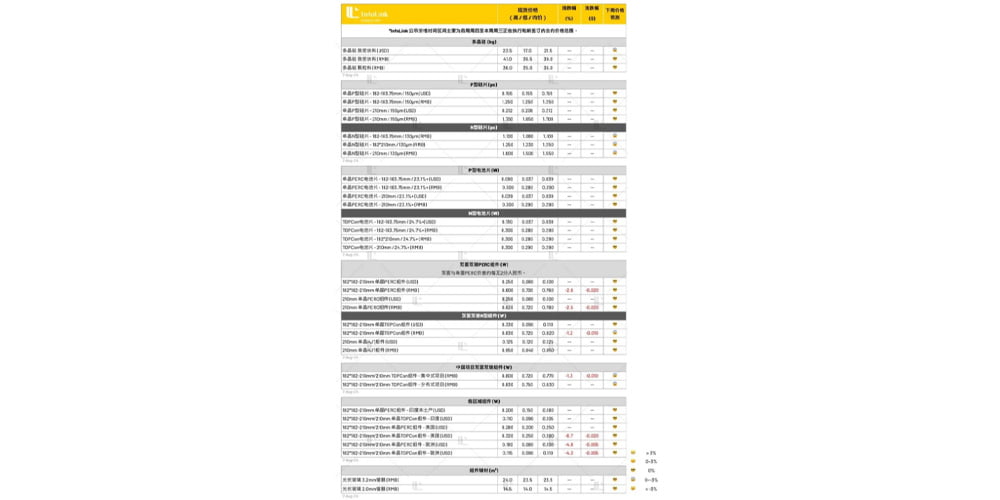

Silicon Material Prices

Recently, market attention toward upstream polysilicon prices has increased again. According to InfoLink, the transaction level for low-priced polysilicon has indeed picked up. As reflected in the price release information on Wednesday, we have been consistently noting this change over the past 2-3 weeks. The mainstream low-price range has risen from 36 yuan per kilogram to between 36 and 37 yuan. By early August, the overall quoted range has also increased, from 36-39 yuan per kilogram to 37-42 yuan. This comes against a backdrop of continuous cash cost losses for companies over the past four months, indicating that prior price levels have indeed reached a bottom (feedback has been recorded in weekly price reviews). Currently, both the low prices and overall quotation ranges have changed.

The rise in low prices and quotation ranges is directly related to the ongoing cash cost losses faced by companies. Additionally, larger-scale maintenance and production cuts on the supply side entering the third quarter are significant contributing factors. From August, major reductions in production at the top three companies have severely impacted the overall market atmosphere. However, whether the market average, as a key price indicator, will adjust as hoped or achieve a rebound remains to be seen and requires further time for validation. InfoLink is closely monitoring these changes.

Regarding inventory, the supply side has seen a noticeable reduction in quantity and trends, as well as clearer signals of price stabilization, prompting related parties to increase purchasing levels. This has resulted in purchasing volumes slightly exceeding the current actual production demand in the market. Observations suggest that the overall inventory levels on the supply side continue to decline, leading to some changes in inventory distribution. It is crucial to emphasize that the current reduction in overall inventory pressure is predicated on significant production cuts in July. For the second half of the year, the overall inventory will still face the pressure of normalizing levels.

Silicon Wafer Prices

Recently, the demand for the 210N and 210RN series products has been affected by weak end-market performance, resulting in a relatively soft price trend. The 183N series has also begun to show signs of loosening, with some companies quoting around 1.08 RMB per piece; however, bulk transactions have not yet materialized.

This week, silicon wafer prices have remained stable. For P-type wafers, transaction prices for M10 and G12 sizes are around 1.25 and 1.70 RMB per piece. For N-type wafers, prices for M10, G12, and G12R sizes are approximately 1.08-1.10, 1.55, and 1.23-1.25 RMB per piece. There is a downward trend in transactions for the 210N and 210RN series, with 210N wafers selling for 1.50-1.55 RMB per piece, and transactions for 210RN wafers at 1.23 RMB each have also begun. A price of 1.20 RMB per piece is anticipated to occur in August.

Looking ahead to August, wafer price trends will continue to be influenced by changes in silica supply and demand. If upstream silica prices rebound, it will have a cascading effect on wafer prices, and subtle fluctuations in supply and demand for specific specifications may also impact the price stability of certain types. Additionally, recent leadership changes announced by major wafer manufacturers have garnered market attention, particularly regarding the production and sales strategies of new decision-makers, with the possibility of production cuts not being ruled out.

Battery Cell Prices

In the first half of the year, the adoption of laser-assisted sintering (LECO) technology became standard among TOPCon battery manufacturers, leading to ongoing production line optimization efforts that have increased efficiency. Currently, the mass production and stock-in efficiency has reached 24.9%, with some reports showing figures of 25% or higher. InfoLink is also expected to adjust the public efficiency rate for TOPCon battery cells in its weekly price announcements in August.

This week, the mainstream transaction price for battery cells has stabilized at 0.29 RMB per watt across the board. The specific transaction price ranges are as follows: P-type M10 and G12 sizes maintain a price of 0.28 to 0.29 RMB per watt. For N-type cells, the average price for M10 TOPCon battery cells is also in the range of 0.28 to 0.29 RMB per watt. Meanwhile, the prices for G12R and G12 TOPCon battery cells remain in the ranges of 0.28 to 0.29 and 0.29 to 0.30 RMB per watt, respectively. The larger N-type 210N and 210RN cells are facing similar challenges as silicon wafers, with sluggish demand impacting production willingness.

Currently, battery prices are relatively stable. On one hand, battery manufacturers continue to deal with declining module prices; on the other hand, the recent drop in silver point prices has eased some of the production pressures on battery companies. However, the overall profitability situation, with sustained gross margins below -10%, continues to affect market sentiment. Companies are struggling to maintain prices within the 0.29 to 0.30 RMB per watt range, with limited expectations for downward movement.

Component Prices

This week, prices have slightly adjusted, primarily influenced by centralized project pricing, which is currently around 0.75-0.78 RMB per watt. Mid-to-late stage manufacturers are still constrained by order conditions, leading to some low bargain prices. Additionally, new orders have emerged at even lower prices this week. In contrast, distributed project prices remain stable, ranging from 0.78-0.85 RMB per watt. The overall average price for TOPCon is expected to approach 0.80 RMB per watt, with a possibility of dropping to 0.78 RMB by the end of the month.

The price range for 182 PERC double-glass modules is about 0.70-0.80 RMB per watt. HJT modules are priced between 0.84-0.95 RMB per watt, with larger projects leaning toward lower prices. As current module prices have been affected by market conditions and hit a low point, the price gap between P-IBC and TOPCon has narrowed from being nearly equal to about 1-2 cents. The N-TBC segments have limited projects domestically, and current quotations are unclear, awaiting updates from manufacturers.

Demand has not shown significant recovery yet, with support primarily coming from large domestic projects expected to ramp up in August, while overseas demand remains stable. Few are accepting higher price offers, and the market is still flooded with low-priced bids, inefficient products, and excess inventory, which continue to drive prices down and disrupt market rhythm, making recovery in module prices challenging.

In the overseas market segment, HJT prices have declined to around $0.12-$0.125 per watt. PERC prices are approximately $0.09-$0.10 per watt. There is a clear price differentiation in the TOPCon segment; prices in the Asia-Pacific region are around $0.10-$0.105, while prices in Europe and Australia are approximately €0.085-€0.115 and $0.105-$0.13, respectively. In the Brazilian market, prices range from $0.085 to $0.12, and prices in the Middle Eastern market have continued to drop within the $0.09-$0.11 range, with the average for major projects close to $0.10. In Latin America, prices are between $0.09 and $0.11.