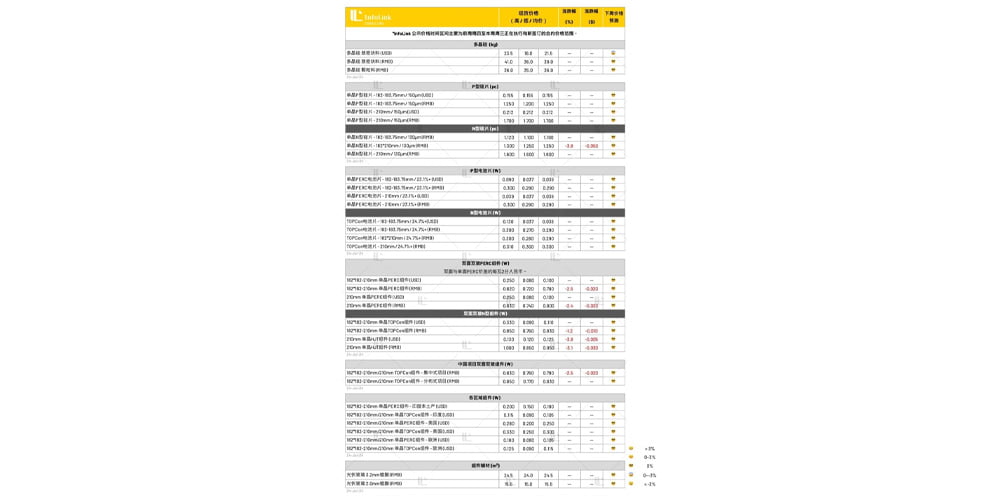

Silicon Material Prices

There are increasing signals indicating that prices in the upstream silicon material sector are reaching a bottom. The price range for domestic block silicon remains between 36-41 yuan per kilogram, while granular silicon prices are stable at 35-36 yuan per kilogram. As highlighted in previous weekly reports, the current price level has substantially fallen below the production cash costs of leading enterprises, leading to a continued weakening of downward momentum and forming a current price floor.

From the supply perspective, the month-over-month decline in supply volume has been larger than initially anticipated, and the trend of reduced supply is expected to continue into August. Thus, there is a significant likelihood of a continued decline in overall supply in August. This trend of shrinking supply, coinciding with prices having reached a bottom range, has led to a recent improvement in purchasing inquiries. Notably, there has been a marked improvement in the purchasing and negotiation environment for new orders driven by rigid demand. There is even an expectation that overall material demand and operational levels in the crystal pulling segment may see a slight rebound in August. The market atmosphere following the price stabilization is also experiencing subtle changes. For prices below the breakeven point, the supply side is under pressure, struggling to operate, creating an environment ripe for potential price recovery

In terms of inventory, the supply side has seen a noticeable reduction in output and a clear trend, along with relatively clear signals of price stabilization. This has prompted relevant parties, including some manufacturing firms, to increase their purchasing volume, leading to a market situation where the buying amount slightly exceeds the current actual production demand. We are currently observing that the overall inventory level on the supply side continues to decline, alleviating some pressure from excess inventory. However, based on the premise of reduced production on the supply side, overall inventory will still face the pressure of normalization in the latter half of the year. Recently, silicon wafer prices, particularly for the 210RN variety, have exhibited relative weakness, with transaction prices still trending downward. This week, mainstream prices reached around 1.25 RMB per wafer, and there is a trend approaching 1.2 RMB per wafer.

Regarding silicon wafer prices, this week they have remained stable, with P-type wafers in sizes M10 and G12 transacting at 1.25 and 1.7 RMB per wafer, respectively. For N-type wafers, prices for M10, G12, and G12R sizes settled at around 1.1, 1.6-1.65, and 1.25 RMB per wafer, respectively.

Looking ahead, despite a slight rebound in prices from some companies earlier, there is still a substantial volume of 183N256 diagonal specification wafers priced at 1.12 RMB each under delivery. The current supply-demand relationship remains relatively oversupplied, leading the market to adopt a pessimistic outlook while manufacturers are paying attention to the potential demand momentum in August.

Battery Cell Prices

This week, prices remain steady, with P-type M10 and G12 sizes holding at 0.29 RMB per watt. For N-type battery cells, the average price for M10 TOPCon cells is also 0.29 RMB per watt, with some lower prices even dropping below 0.27 RMB per watt. Current prices for G12R and G12 TOPCon battery cells are maintained between 0.29 and 0.3 RMB per watt.

Battery cells continue to face losses; for M10 TOPCon cells, based on a tax-inclusive cost of 0.29 RMB per watt, the gross margin is estimated to be between -11% and -12%. With elevated inventory levels, the market outlook remains pessimistic. Given cost considerations, there is currently no room for price decreases, yet from a supply-demand perspective, there is still an oversupply issue. Companies in this sector remain stuck in a prolonged situation of unprofitability. However, it has been observed that firms are maintaining price supports for high-efficiency

Component Prices

This week, prices have slightly fluctuated. The primary change is that the prices of TOPCon components in concentrated projects are nearing 0.76-0.80 RMB, while distributed project prices range from 0.78 to 0.85 RMB, resulting in an overall average price of 0.80-0.83 RMB per watt. Observations of manufacturer pricing strategies show that leading manufacturers maintain prices in the range of approximately 0.78-0.80 RMB, whereas mid-tier manufacturers are constrained by order conditions, leading to slightly lower pricing due to limited margins. Looking ahead, some manufacturers have begun to attempt price increases, primarily due to the belief that supply chain prices have hit a bottom, although this is dependent on individual order statuses; some manufacturers are seeing a slight uptick in orders. However, a more significant recovery in overall demand is still awaited, as there are currently no clear signs of recovery. The market is still disrupted by low-price bidding and a rapid decline in the prices of less efficient products, making it challenging for component prices to recover. At this time, maintaining price stability seems more achievable.

The price range for 182 PERC double-glass components is approximately 0.72-0.85 RMB per watt, with a significant decrease in domestic projects causing prices to gradually fall below 0.80 RMB. HJT component prices range from about 0.85 to 1.00 RMB per watt, with the average price trending towards 0.95 RMB; large project prices are also occasionally seen below 1 RMB.

In the overseas market, HJT prices have decreased to about 0.12-0.13 USD per watt, while PERC prices are around 0.09-0.10 USD per watt. TOPCon prices show significant regional variation, with prices in the Asia-Pacific region around 0.10-0.105 USD; in contrast, prices in Europe and Australia are approximately 0.085-0.115 EUR and 0.105-0.13 USD, respectively. In the Brazilian market, prices range from 0.085 to 0.12 USD, while prices in the Middle East continue to drop within the 0.09-0.12 USD range, with large projects averaging close to 0.10 USD. In Latin America, prices range from 0.09 to

-195x300.jpg)

Price Description

The InfoLink public price time frame primarily covers the price range of contracts executed and newly signed from the previous Thursday to the current Wednesday.

Spot prices are mainly referenced from information provided by over 100 manufacturers. The prices published are based on the most frequently traded “mode” data in the market (not a weighted average) and are adjusted based on actual market conditions as appropriate.

The dollar price of polysilicon primarily reflects the dollar price range corresponding to polysilicon sourced from “non-China” locations, calculated without conversion to RMB.

For high-priced solar cells, the PERC/TOPCon M10-sized solar cells are primarily based on prices for cells produced in Southeast Asia.

In the module segment, the RMB prices reflect quotes for domestic demand in China, with the average price based on the factory delivery price for the week (excluding inland transportation costs). This primarily accounts for the distribution of delivered distributed and centralized projects during the current period, with high and low prices reflecting the market status of second-tier manufacturers or certain earlier